From the basement of MIT to many world firsts

SES AI HISTORY

Inception at MIT, mentored by battery greats

It's not surprising that SES’s innovation in EV batteries all started in Lab 4-061 in the basement of Building 4 at MIT, the institute that propelled many of America’s technological innovations. After working on photovoltaics at Harvard from 2007 to 2009, SES founder and CEO Dr. Qichao Hu joined renowned battery expert and material chemistry pioneer Donald Sadoway’s group at MIT as a doctoral and then post-doctoral researcher on Solid Polymer Ionic Liquid (SPIL) Li-Metal batteries. Professor Sadoway, named one of Time magazine's 100 Most Influential People in the World in 2012 for accomplishments in energy storage, had been working on Solid Polymer Electrolyte (SPE) Li-Metal batteries since the late 1990s. Sadoway's work was accelerated in 2007 when the U.S. Department of Energy boosted its research funding for batteries, and MIT established the MIT Energy Initiatives. Under Sadoway's mentorship, Hu co-developed the SPIL Li-Metal battery, which demonstrated transformational energy density and safety and led to the founding of SolidEnergy Systems as SES was then called. The fundamental studies done at MIT remain at the core of our Li-Metal development today.

Department of Energy (DOE) win and incorporation as SolidEnergy Systems

SES officially began its journey as SolidEnergy Systems on April 17, 2012. We hired a small team with award money from business plan competitions, including a prestigious DOE-sponsored Clean Energy Prize and two MIT awards, the MIT $100K and MIT Clean Energy Prize.

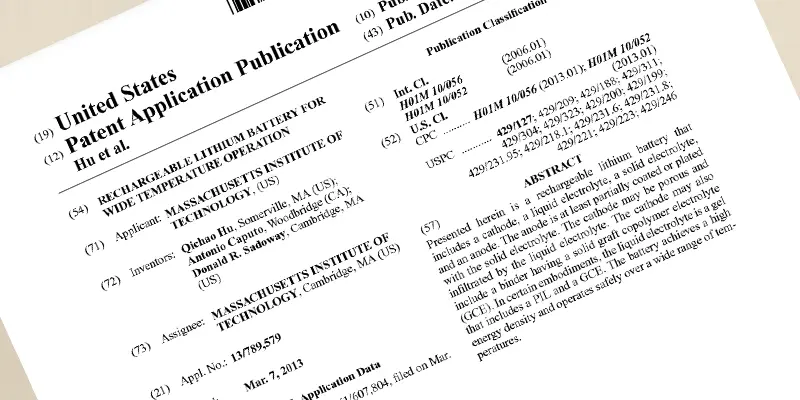

Patent with MIT and first R&D samples

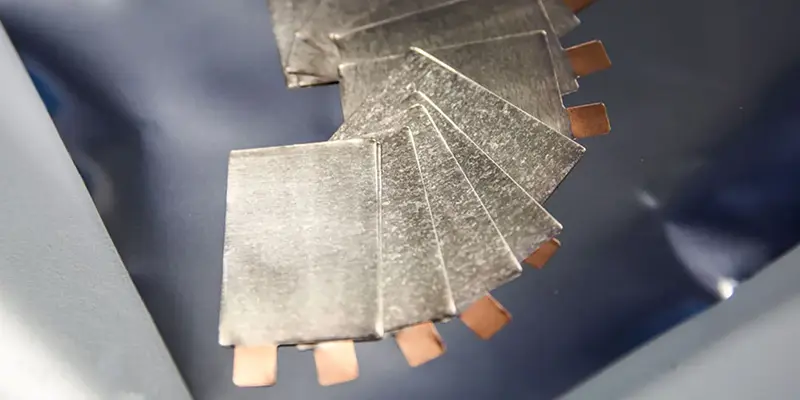

MIT filed and won a patent for a rechargeable lithium battery for wide temperature operation invented by Dr. Hu, Sadoway, and Antonio Caputo. SES won a worldwide exclusive license to this patent. We eventually dropped this license when we pivoted away from solid-state to liquid Li-Metal in 2015. It was a difficult decision back then, but looking back it was the best decision we made. We also began using U.S. battery manufacturer A123's R&D facility in Waltham, Massachusetts, which had one of the best prototyping lines in North America. We built our first Li-Metal R&D samples on this line.

Series A

We raised a Series A round from Vertex Ventures. We also formalized the relationship with A123 and set up a 3,000 sq. ft. lab in their Waltham, Massachusetts R&D facility.

Discovery of solvent-in-salt electrolyte

Due to fundamental challenges in manufacturability, we shifted from solid-state Li-Metal as our focus and discovered a novel high concentration solvent-in-salt electrolyte. The high concentration solvent-in-salt electrolyte remains at the core of our development today.

Series B

We raised a Series B round led by major U.S. automaker General Motors and syndicated by Shanghai Auto (SAIC), Applied Ventures, and all existing investors who participated in the Series A round.

New headquarters in Woburn, Massachusetts

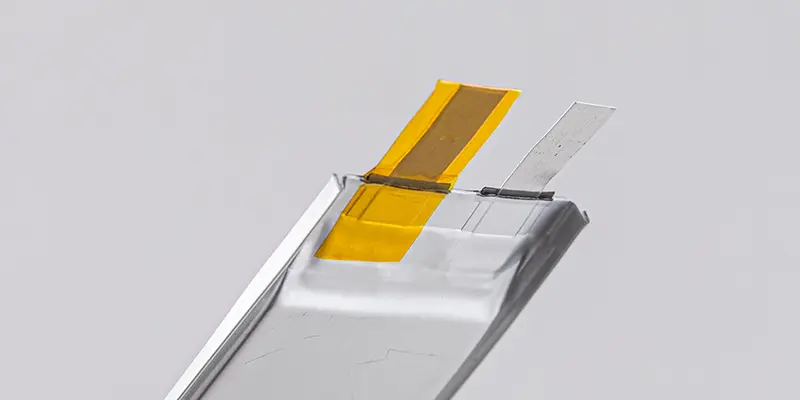

We cemented our roots in Massachusetts, moving from Waltham to Woburn just outside Boston, expanding our footprint from 3,000 to 25,000 sq. ft. and developing Hermes, 4Ah pouch cells that would become our platform for new material development. This location continues to be our global headquarters today.

Series C and C+

We raised a Series C round from Temasek and Tianqi Lithium, one of the world's largest lithium producers. We also raised a Series C+ round from SK Inc., whose insights and strategy around the global supply chain would eventually inform our own strategy to build AI software that tracks battery development from mining all the way to the hands of consumers.

Significant progress in development and engineering

SES AI made significant progress in cell and materials R&D and engineering from 2016 to 2021. We developed Gen 1 to Gen 3 electrolytes from 2013 to 2019, and from Gen 4 to Gen 15+ from 2019 to 2022. During this time, we also started developing our Hermes cells and began working with a Li-ion equipment vendor on the Li-Metal cell assembly process and equipment, proving the manufacturability of hybrid Li-Metal and laying the groundwork for our pilot lines in SES Korea and Shanghai Giga; the building, testing, and demonstration of Apollo, the world’s first 100+ Ah Li-Metal cells; and manufacturing quality control and data collection for Avatar. We also started sending cell samples to potential customers (very rare in the Li-Metal industry at that time) and built a transparent and data-driven culture, winning contracts based on superior performance validated by third-party and customer test data.

A-sample joint development agreement with General Motors

GM's venture arm first invested in SES in 2015. As the next progression in our ongoing collaboration, GM and SES entered into an A-sample joint development agreement in March 2021 to improve the energy density of batteries with the ultimate goal of helping to drive mass adoption of EVs. SES is the first Li-Metal battery company in the world to enter into an A-sample JDA with a major automaker.

Series D and D+

SES announced Series D and D+ funding rounds led by General Motors and Hyundai. Additional contributors included existing investors SK, Temasek, Applied Ventures, Shanghai Auto, and Vertex. The round was intended to help accelerate technology development, significantly expand our technical, business, and manufacturing teams, and expedite the commercialization of Li-Metal batteries.

SES enters into an A-sample JDA with Hyundai

SES entered into an A-sample JDA with Hyundai in July 2021 as part of the automaker's strategy to transform itself into a global mobility technology leader and meet global vehicle demand as it shifts to zero-emission vehicles over the next two decades.

SES enters into an A-sample JDA with Honda

SES entered into an A-sample JDA with Honda Motor Company in December 2021. Honda, which is accelerating electrification of its products on a global basis, considers the battery a crucial component of EVs. The JDA with SES is part of Honda's overall battery strategy.

Apollo, world's first 100+Ah Li-Metal battery, unveiled

We introduced to the world a 107Ah Li-Metal battery - the largest in the world and a breakthrough for the automotive industry. Apollo can deliver 107Ah, weighs only 0.982 kg, and has an energy density of 417 Wh/kg and 935 Wh/L. This first-of-its-kind large-format Li-Metal cell was unveiled at SES Battery World 2021. SES continues to work with our OEM partners to optimize this battery and bring it to commercial production.

SES Shanghai announced

SES began building the largest Li-Metal facility in the world to help the company and its OEM partners be the first to commercialize this next generation Li-Metal battery. SES Shanghai is a 300,000 sq. ft. facility.

SES goes public

On February 4, 2022, SES AI reached another major milestone when we listed on the New York Stock Exchange under the ticker symbol of “SES” for our common stock. The company went public through a SPAC merger with Ivanhoe Capital Acquisition Corp. Anchor investors to our SPAC PIPE included six of the world’s automakers, namely General Motors, Hyundai, Honda, Geely, Foxconn, and Shanghai Auto, and a few strategic investors.

Company changes name to SES AI Corporation

We officially changed our name from SolidEnergy Systems to SES AI Corporation

Expansion to South Korea to double down on engineering and manufacturing capabilities for large automotive cells

SES continued its global expansion, announcing plans to build a pre-production facility in South Korea to speed up manufacturing. South Korea is home to several of SES’s important strategic partners including Hyundai, SK, and LG, and has a strong battery supply chain and deep talent pool. SES Korea and SES Shanghai will focus on different aspects of supply chain development and different A-sample joint development with automotive OEMs. SES Korea will also participate in several exciting Urban Air Mobility (UAM) initiatives in South Korea, which considers UAM as more strategically urgent than EV.

Preparing for B-sample phase of Li-Metal cell manufacturing

SES AI announced that it is preparing Line 4, its most-advanced Li-Metal cell manufacturing line in preparation for B-sample. Line 4 will have far superior processes, quality, yields, and run-rates compared to our A-sample lines. This line will also be fully integrated with our pioneering Avatar AI software and will collect and send manufacturing data seamlessly to our AI battery health monitoring software. Line 4 will be a major milestone for the automotive commercialization of Li-Metal cells. It's expected to be fully operational and ready to use in the first half of 2024.