March 21, 2022 From oil to battery and back to “oil”

Oil companies created the battery

In the late 1960s and early 1970s, the US reached peak oil production putting upward pressure on oil prices, exacerbated by conflicts in the Middle East, an oil crisis began unfolding and prompted the first shift towards energy-efficient technologies to power vehicles. Exxon, one of the largest oil and gas companies started recruiting young scientists to work on these alternative technologies. Stanley Whittingham, then a young post-doctoral fellow from Stanford joined Exxon in 1972. Stanley would later invent intercalation chemistry, and together with John Goodenough and Akira Yoshino would lay the groundwork for the world’s first Li-ion battery and win the Noble prize in chemistry in 2019. The Li-ion battery that the trio helped develop would go on to power all of our consumer devices and electric vehicles, and enable the era of social media, big data, artificial intelligence, cloud computing, blockchain, clean transportation, etc.

Oil companies not only helped create the first Li-ion battery, they continue to produce specialty chemicals that are used as additives, polymer membranes and other molecules in batteries. Many large battery companies today have their roots in petroleum related business such as LGES (formerly LG Chem) and SKon (formerly SK Innovation).

Most battery companies will not survive

Today the world’s three largest EV battery producers are CATL, LGES and Panasonic, with 31.8%, 20.5% and 12.5% of global market share respectively in 2021, and the top ten account for more than 90% of the global market share. CATL has the highest margin (in the teens), while others are in the single digits or even fluctuating between positive and negative.

The EV battery industry is extremely capital and technology intensive, only the well-funded and innovative ones can survive, small companies without strong technology cannot survive and the industry has gone through significant consolidation in the past few years. In China, the number of EV battery companies decreased from almost 200 in 2016 to less than 20 in 2021, with CATL controlling more than half and the top five controlling almost 90% of China’s market share.

Traditional EV battery supply is also extremely risky especially when there is a safety recall. For large companies like LGES, the GM Chevy Bolt recall costed LGES almost $2 bn, and the Hyundai recall costed LGES another $1bn, a total of $3bn in recall expense. In comparison LGES’s 2021 operating profit was about $640m, and 2021 was a year that saw explosive growth in EV battery demand, so one safety recall wiped out more than 5 years of profit. For smaller companies like A123, the Fisker recall in 2012 costed them more than $60m and directly bankrupted the company. While some car companies diligently incubate promising battery companies to become their suppliers, many would not think twice about bankrupting their suppliers.

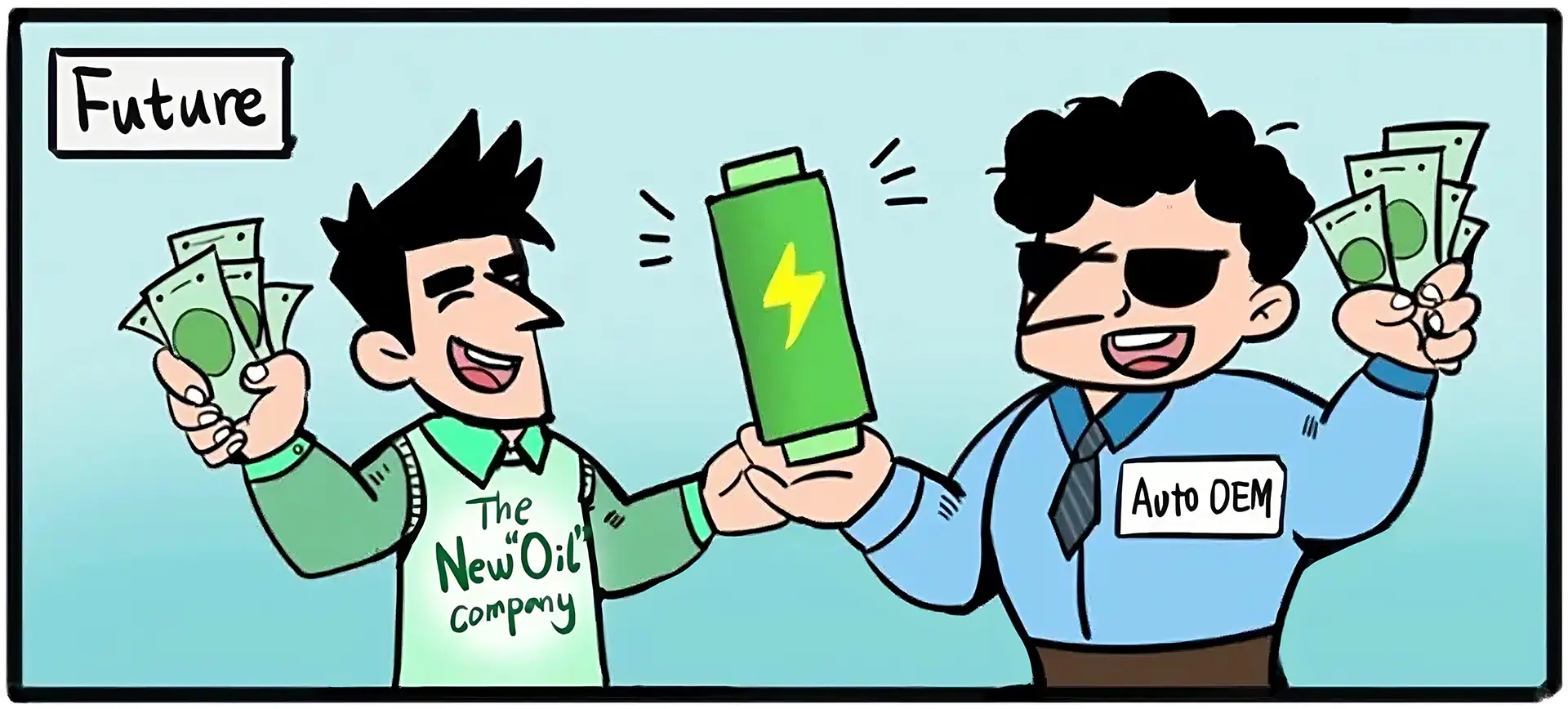

Battery companies are becoming new “oil” companies

Many car companies have announced aggressive cost target of 60 $/kWh by mid-decade and 50 $/kWh by 2030. Such aggressive cost target forces industry consolidation and vertical integration. With EV batteries accounting for almost 40% of the cost of the entire car, car companies intend to eat battery companies’ lunch. Some car companies even announced plans to become battery companies and make batteries themselves.

With mounting pressure and challenge from car companies, battery companies must innovate to survive. Upstream, battery and car companies are competing for raw material supply chain. CATL recently bought Millennial Lithium, Neo Lithium, North American Nickel and Pilbara Minerals. LGES entered into offtake agreement with Australian Mine and Sigma Lithium. SKon also entered similar offtake agreement with Australian Mine and is looking to secure additional raw material supply with other mines. Tesla secured lithium supply with the world’s largest producer Ganfeng Lithium and also signed offtake agreement with junior mines.

Downstream the competition is also intensifying. CATL recently unveiled EVOGO, its modular battery swapping solution. Instead of selling batteries to car companies and making little margin, this allows the battery company to directly supply or lease its batteries to end users and capturing far greater value, effectively rendering the car companies to design houses that make boxes with wheels. This fundamentally changes the game, and gives battery companies far greater advantage. Traditional oil companies have oil fields, oil refinery and gas stations. Now CATL is becoming the new “oil” company with mines, battery manufacturing and swapping stations.

Car companies wish the battery companies could simply hand over their technology so the car companies could manufacture batteries themselves, or simply contract manufacture batteries with bare minimum margin for the car companies. Battery companies wish the car companies could use the same modular battery platform so the battery companies could lease batteries directly to end users (BaaS battery-as-a-service).

We are in the midst of another oil crisis, and seeing another strong push for EV on top of already accelerated transition. Will car companies eat battery companies’ lunch? Or will battery companies become the new “oil” companies and car companies become design houses for boxes on wheels? Or will battery and car companies coexist in a more equitable way? In the next few years, we will see seismic changes in the industry.

Share this post

Author

-

Dr. Qichao Hu is the founder and CEO of SES AI (NYSE: SES), the Boston-based company pioneering the world’s lightest long-range Li-Metal battery and transparent EV battery supply chain. Dr. Hu has a BS in Physics from MIT and a PhD in Applied Physics from Harvard.

View all posts